Calculating Property Taxes

Calculating 2025 property taxes (to be paid in 2026)

Beginning with 2025 property taxes, as a result of HB24B-1001, residential property will have two assessment rates. One assessment rate will be used to calculate local government assessed values, and the other rate will calculate school district assessed values.

2025 Assessment Rates

| Classification | 2025 Rate |

| Residential - Local Government | 6.25% |

| Residential - Schools | 7.05% |

| Vacant Land | 27% |

| Commercial | 27% |

| Commercial Lodging | 27% |

| Industrial | 27% |

| Agricultural | 27% |

| State Assessed Renewable Energy | 27% |

Tax Rate

Late each year county commissioners, city councils, school boards, governing boards of special districts, and other taxing authorities determine the revenue needed and allowed under the law to provide services for the following year.

Each taxing authority calculates a tax rate based on the revenue needed from property tax and the total assessed value of real and personal property located within their boundaries. The tax rate is often expressed as a mill levy.

The tax rates of the various taxing authorities, except schools, providing services in your tax area are added together to form the total local government tax rate.

Example for property within the Town of Silverton:

| San Juan County Tax Rate | 0.019001 |

| Town of Silverton Tax Rate | 0.009777 |

| SW Water Conservation District | 0.000356 |

| Total Local Government Tax Rate | 0.028814 |

Calculation of Property Tax (residential example)

| Actual Value | $500,000 |

| Local Government Assessed Rate | × 0.0625 |

| Local Government Assessed Value | $31,250 |

| Local Government Tax Rate | × 0.0288136 |

| Local Government Taxes Due | $900.43 |

| Actual Value | $500,000 |

| School District Assessed Rate | × 0.0705 |

| School District Assessed Value | $35,250 |

| School District Tax Rate | × 0.016628 |

| School District Taxes Due | $586.14 |

| Local Government Taxes Due | $900.43 |

| School District Taxes Due | + $586.14 |

| Total Taxes Due | $1,486.57 |

For more detail, see: https://dpt.colorado.gov/understanding-property-taxes-in-colorado

2025 property tax calculations

Actual Value x Assessment Rate x Mills = Property Taxes

- Actual Value is set by the County Assessor and can be found on Notices of Valuation and Tax Notices

You can also find actual value online

- Assessment Rate is set by the State Legislature and State Property Tax Administrator:

- 27.0% for most non-residential property

- 6.25% Local Government rate for residential property

- 7.05% School district rate for residential property

- Mill Levies are set by local taxing entities. The sum of Mills that apply to a given property is used to calculate taxes.

Mills should be divided by 1000 to calculate taxes.- 19.001 San Juan County (all property in SJC)

- 16.628 School District #1 (all property in SJC)

- 09.777 Town of Silverton (property within Silverton)

- 11.730 Durango Fire Protection District (property in S. County)

- 00.356 SW Water Conservation District (all property in SJC)

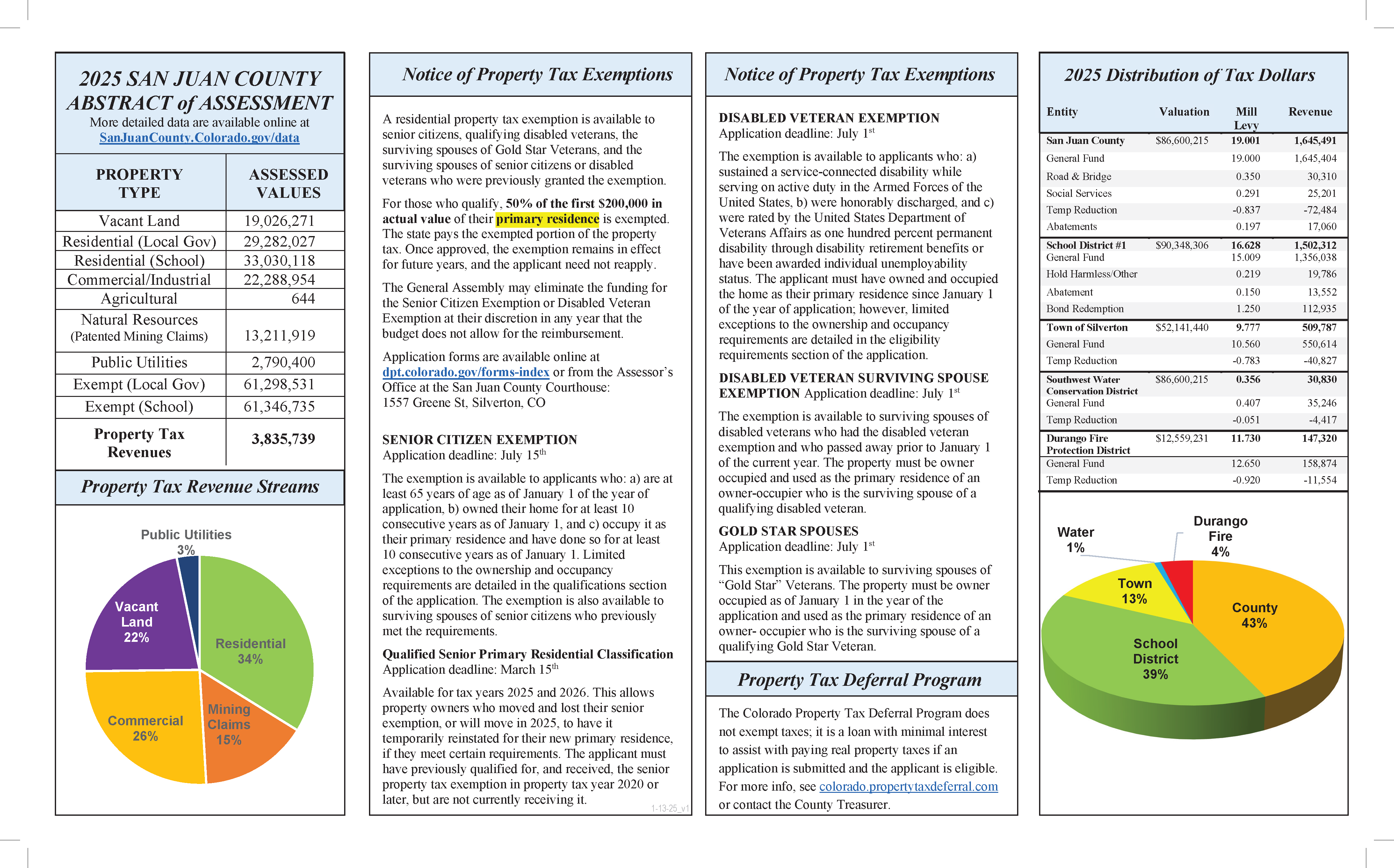

Annual Abstract of Assessment

The Abstract of Assessment is produced each January for the previous year. The brochure provides the tax rates and revenues for all taxing entities in the County, and the distribution of taxes by type of taxing authority. San Juan County currently has 3 tax districts and 5 taxing entities.

2025 Abstract Brochure (pdf)